There is been a good deal of talk about the downward financial pressures that have pummeled the marketplaces in 2022 – perhaps far too considerably this kind of communicate. Indeed, the S&P 500 is down virtually 21{da793fdcd3fe679df000853cab620e3a76d4f41f7c86540cc967171bbb315377}, and the NASDAQ is down 35{da793fdcd3fe679df000853cab620e3a76d4f41f7c86540cc967171bbb315377}, but traders can continue to uncover audio possibilities. J.P. Morgan analyst Ryan Brinkman has been sorting through the automotive marketplace stocks, and he’s identified numerous that are value a nearer search.

So let us do just that. We know that the car sector has its possess unique headwinds, such as the ongoing microchip scarcity and uncooked product value inflation, and that these are pumping up rates. But the supply chain difficulties are easing, and are envisioned to ease even more into 2023.

Brinkman, in some general notes on marketplace, writes, “There are some glimmers of normalization, with costs finally easing to some degree, while conditions stay far from normal…. 2023 has greater prospective for a far more swift enhancement in the volume setting and a much more quick normalization in pricing, with the wildcard staying an economic downturn.” Putting some quantities on this prediction, Brinkman’s colleagues at JPM are modeling 2.5{da793fdcd3fe679df000853cab620e3a76d4f41f7c86540cc967171bbb315377} to 5{da793fdcd3fe679df000853cab620e3a76d4f41f7c86540cc967171bbb315377} selling price moderation in new motor vehicles, and 10{da793fdcd3fe679df000853cab620e3a76d4f41f7c86540cc967171bbb315377} to 20{da793fdcd3fe679df000853cab620e3a76d4f41f7c86540cc967171bbb315377} in utilised motor vehicles, by means of the calendar 12 months 2023.

As for trader positioning, Brinkman is tapping two auto-associated shares for one-12 months gains very well in extra of 60{da793fdcd3fe679df000853cab620e3a76d4f41f7c86540cc967171bbb315377}. Let us acquire a search at these two picks, using the most current info from TipRanks as well as the analyst’s comments, to get a really feel for their potential.

Kar Auction Products and services, Inc. (KAR)

1st up, KAR Auction, a chief in the world’s second-hand motor vehicle auction industry. The corporation operates in each the on line and physical worlds, connecting sellers and potential buyers, and counts both of those corporations and personal consumers in its client foundation. KAR presents automobiles for a large selection of makes use of, from business fleets to non-public travel to the second-hand vehicle pieces industry. Pre-pandemic, in 2019, KAR bought 3.7 million cars and produced $2.8 billion in auction profits.

The blend of, initially, COVID, and next, higher inflation, has pushed down on KAR’s major line the company noticed $2.25 billion in total revenues for 2021, and so significantly this year the revenue totals are not matching that. In the final quarter, 3Q22, the company described $393 million at the major line. This was down 26{da793fdcd3fe679df000853cab620e3a76d4f41f7c86540cc967171bbb315377} yr-above-calendar year but a sequential improvement which the company attributed to an enhance in gross earnings for every motor vehicle marketed, and to greater rates, which have offset reduced volumes. KAR saw a gross profit for every motor vehicle sold of $320, up 14{da793fdcd3fe679df000853cab620e3a76d4f41f7c86540cc967171bbb315377} from the $280 reported in the prior year’s Q3.

Also indicating a optimistic outlook, KAR claimed a web profit, with adjusted internet cash flow for 3Q22 coming it at 9 cents for every diluted share. This compared favorably to the 11-cent loss documented a person yr previously.

In his protection of this stock for JPM, Ryan Brinkman points out numerous reasons why the organization has been in a position to endure the present-day industry problems – and why it is most likely to stand tall going forward. He writes, “KAR has a robust place in this marketplace: it is the 2nd-largest supplier of entire car or truck auction services. The ensuing minimal level of competition and large obstacles to entry consequence in powerful pricing and margins and sturdy free dollars flow supplied very low operating capital prerequisites. We expect strong profit advancement around the next a number of a long time, driven by cyclical restoration in at this time depressed industrial consignor volumes and the firm’s force into the digital Dealer-to-Dealer space alongside with predicted ongoing expense containment and exploration of a lot of adjacencies, which include retail reconditioning.”

These responses again up Brinkman’s Obese (Get) rating, and his $22 cost focus on implies a acquire of 75{da793fdcd3fe679df000853cab620e3a76d4f41f7c86540cc967171bbb315377} for the shares about the subsequent 12 months. (To check out Brinkman’s track record, click listed here.)

Brinkman is not the only analyst who is bullish on the long term of KAR the stock has 4 the latest evaluations, all positive, for a unanimous Sturdy Invest in analyst consensus. The common value target is $22, matching Brinkman’s aim. (See KAR’s inventory forecast at TipRanks.)

Special close-of-year supply: Access TipRanks Quality resources for an all-time small price! Simply click to learn additional.

Tenting Environment Holdings (CWH)

Next up is a specialised car or truck inventory, Camping Earth Holdings. This organization discounts in recreational autos, presenting a selection of towed and driven RVs for sale new and applied, as properly as supporting equipment, equipment, and other linked products and solutions like boating and drinking water athletics vessels and their equipment. In small, Tenting Environment Holdings puts a planet of outdoor leisure less than a single sales area.

Tenting World’s gross sales and revenues are predictable, and observe a typical seasonal sample with a peak in Q2 and a trough in Q4. With that in intellect, the corporation posted revenues of $1.9 billion for 3Q22, a 3{da793fdcd3fe679df000853cab620e3a76d4f41f7c86540cc967171bbb315377} y/y fall but beating the Street’s forecast by $100 million. Applied device income totaled 14,460, for a enterprise report, and utilized car earnings was up additional than 1{da793fdcd3fe679df000853cab620e3a76d4f41f7c86540cc967171bbb315377}, to $526 million.

The corporation documented better inventories for equally new and used cars, to $1.6 billion, in Q3, an maximize attributed to restocking new autos to usual stages, as perfectly as strategic progress in the used motor vehicle business enterprise. The corporation opened 8 added dealership areas all through the quarter.

On the bottom line, the company observed a steep fall-off. Altered diluted EPS fell from $1.98 in 3Q21 to $1.07 in the the latest quarterly report, a 45{da793fdcd3fe679df000853cab620e3a76d4f41f7c86540cc967171bbb315377} y/y decrease.

Even even though earnings are down, CWH has maintained its typical stock dividend. The business past declared a payment of 62.5 cents for every share, for payment on December 29. At that amount, the dividend annualizes to $2.50 for each frequent share and yields a effective 11{da793fdcd3fe679df000853cab620e3a76d4f41f7c86540cc967171bbb315377}, more than more than enough to defeat the current level of inflation and assure a real price of return.

JPM’s Ryan Brinkman highlights the motives why he believes the stock is one to individual. He writes, “Camping World’s considerably higher scale supplies it with quite a few gains relative to its scaled-down competition, which include (1) gross margin-maximizing volume discount rates (2) much more favorable phrases with financiers (3) the capacity to give individuals a wider assortment by tapping into the inventory out there across its greater selection of shops and (4) an informational edge in terms of shopper desire and pricing in the marketplace. The combination of the fragmented mother nature of the current market and the major gains provided by scale in our perspective provides sufficient possibility to make value by further more consolidating the industry, and Camping World has traditionally been really acquisitive.”

Putting some figures to his stance, Brinkman premiums the inventory as Obese (Purchase) with a $37 price target indicating likely for 72{da793fdcd3fe679df000853cab620e3a76d4f41f7c86540cc967171bbb315377} share appreciation in the coming 12 months.

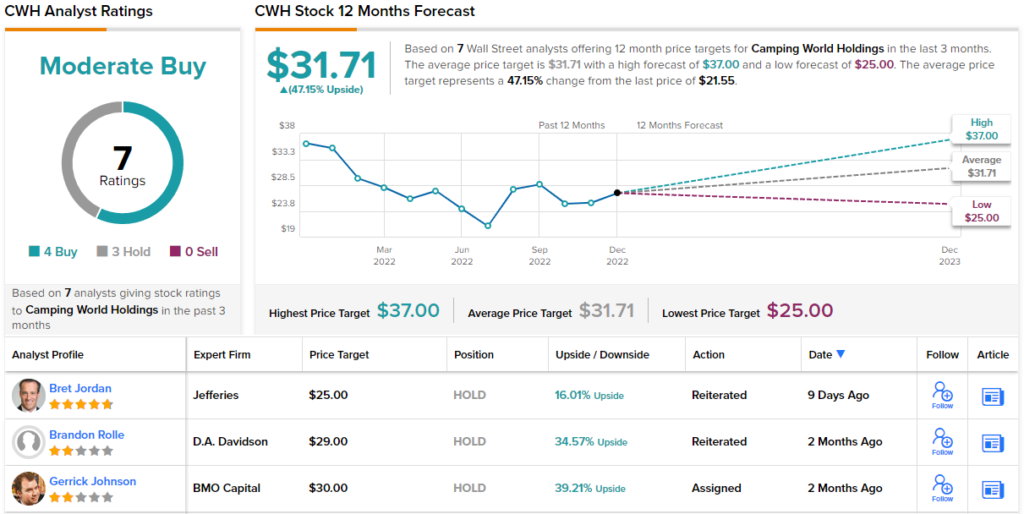

This inventory retains a Average Buy consensus ranking from the analysts on Wall Road, with 7 current critiques breaking down to 4 Purchases and 3 Retains. The inventory is trading for $21.55 and has an ordinary price concentrate on of $31.71, implying a 1-yr upside of 47{da793fdcd3fe679df000853cab620e3a76d4f41f7c86540cc967171bbb315377}. (See Camping Entire world Holdings’ inventory forecast at TipRanks.)

To obtain very good tips for stocks trading at interesting valuations, check out TipRanks’ Best Shares to Purchase, a newly launched resource that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed in this article are only all those of the highlighted analysts. The content material is supposed to be applied for informational applications only. It is really vital to do your personal assessment prior to producing any investment.