https://www.youtube.com/look at?v=0CDCO1vKYNs

The Zacks Retail and Wholesale sector has modestly underperformed relative to the S&P 500 more than the final 12 months, down about 15{da793fdcd3fe679df000853cab620e3a76d4f41f7c86540cc967171bbb315377}.

1 company residing in the sector, Advance Auto Areas AAP, has seen its earnings outlook shift unfavorable in excess of the previous many months, pushing the stock into a Zacks Rank #5 (Sturdy Promote).

Graphic Source: Zacks Expenditure Analysis

Progress Auto Parts mainly sells alternative sections (excluding tires), accessories, batteries, and maintenance items for domestic and imported automobiles, vans, sport utility motor vehicles, and gentle and hefty-duty trucks.

Let us consider a deeper dive into how the firm shapes up.

Share Overall performance

Above the last 12 months, AAP shares have commonly lagged guiding the S&P 500, down more than 30{da793fdcd3fe679df000853cab620e3a76d4f41f7c86540cc967171bbb315377}.

Picture Resource: Zacks Investment Study

And more than the very last a few months, sellers have remained in handle, with shares down 13{da793fdcd3fe679df000853cab620e3a76d4f41f7c86540cc967171bbb315377} and again lagging at the rear of the basic industry.

Impression Supply: Zacks Investment Analysis

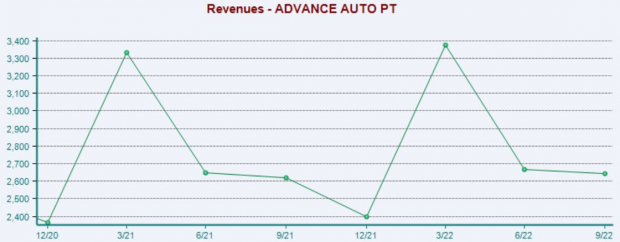

Quarterly Results

Advance Automobile has struggled to obtain consistency inside its quarterly final results, falling small of the Zacks Consensus EPS Estimate in again-to-back quarters. Top rated-line benefits have also still left some to be preferred, with AAP missing revenue expectations in three consecutive quarters.

Just in its newest release, the company fell shorter of earnings expectations by approximately 15{da793fdcd3fe679df000853cab620e3a76d4f41f7c86540cc967171bbb315377} and noted revenue marginally down below estimates.

Image Supply: Zacks Investment decision Study

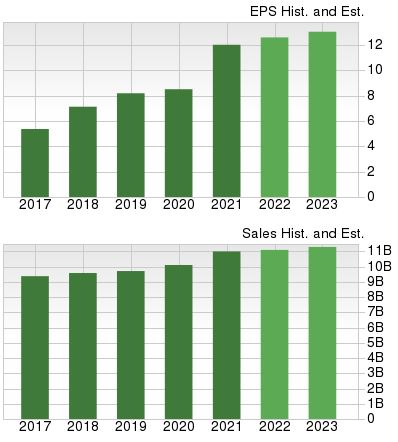

Development Outlook

Even with its earnings outlook coming underneath strain, AAP continue to carries a respectable development profile, with earnings forecasted to climb 5{da793fdcd3fe679df000853cab620e3a76d4f41f7c86540cc967171bbb315377} in its present-day fiscal 12 months (FY22) and a additional 5.4{da793fdcd3fe679df000853cab620e3a76d4f41f7c86540cc967171bbb315377} in FY23.

The projected earnings growth arrives on leading of forecasted Y/Y revenue upticks of 1{da793fdcd3fe679df000853cab620e3a76d4f41f7c86540cc967171bbb315377} in FY22 and 2.6{da793fdcd3fe679df000853cab620e3a76d4f41f7c86540cc967171bbb315377} in FY23.

Graphic Source: Zacks Investment decision Analysis

Base Line

Inconsistent quarterly success and damaging earnings estimate revisions from analysts paint a complicated photograph for the firm in the close to expression.

Advance Vehicle Parts AAP is a Zacks Rank #5 (Strong Provide), indicating that analysts have reduced their bottom-line outlook throughout the last several months.

For those people searching for strong stocks, a fantastic concept would be to focus on shares carrying a Zacks Rank #1 (Robust Buy) or a Zacks Rank #2 (Get) – these stocks activity a notably much better earnings outlook paired with the prospective to supply explosive gains in the in the vicinity of phrase.

7 Most effective Shares for the Subsequent 30 Days

Just launched: Gurus distill 7 elite shares from the latest listing of 220 Zacks Rank #1 Potent Buys. They deem these tickers “Most Likely for Early Price tag Pops.”

Considering the fact that 1988, the full list has overwhelmed the marketplace a lot more than 2X above with an common achieve of +24.8{da793fdcd3fe679df000853cab620e3a76d4f41f7c86540cc967171bbb315377} for each yr. So be certain to give these hand-picked 7 your quick notice.

Advance Auto Components, Inc. (AAP) : Free Inventory Analysis Report

To study this short article on Zacks.com simply click right here.

Zacks Financial investment Exploration

The sights and thoughts expressed herein are the sights and views of the author and do not necessarily mirror people of Nasdaq, Inc.