Progress Automobile Areas, Inc. (NYSE:AAP), is not the most significant corporation out there, but it received a lot of consideration from a significant selling price motion on the NYSE above the past couple of months, escalating to US$157 at a person level, and dropping to the lows of US$111. Some share selling price actions can give traders a much better option to enter into the inventory, and probably acquire at a reduced selling price. A question to answer is irrespective of whether Progress Auto Parts’ current buying and selling rate of US$119 reflective of the genuine price of the mid-cap? Or is it at the moment undervalued, furnishing us with the possibility to purchase? Let us acquire a look at Advance Car Parts’s outlook and benefit centered on the most the latest financial knowledge to see if there are any catalysts for a price change.

See our most recent evaluation for Progress Auto Areas

Is Progress Vehicle Sections However Low cost?

Terrific news for buyers – Progress Automobile Elements is still buying and selling at a rather inexpensive price. My valuation model reveals that the intrinsic value for the stock is $173.51, but it is at this time buying and selling at US$119 on the share market place, that means that there is nonetheless an option to buy now. Having said that, provided that Advance Vehicle Parts’s share is rather volatile (i.e. its selling price movements are magnified relative to the relaxation of the current market) this could suggest the value can sink reduced, offering us an additional prospect to purchase in the upcoming. This is primarily based on its significant beta, which is a very good indicator for share rate volatility.

What type of development will Advance Car Parts create?

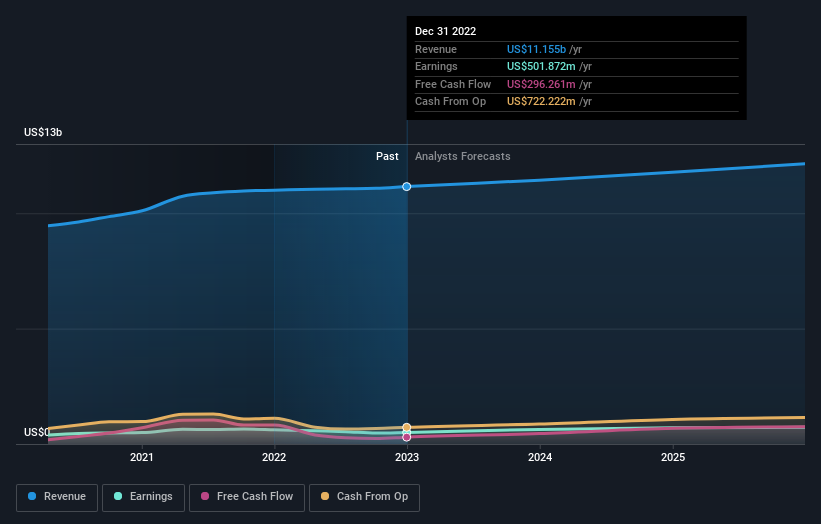

Investors looking for advancement in their portfolio may perhaps want to take into account the prospective buyers of a organization in advance of buying its shares. Getting a excellent enterprise with a strong outlook at a cheap value is constantly a very good investment, so let’s also choose a seem at the company’s long run expectations. Advance Vehicle Parts’ earnings above the subsequent several decades are envisioned to increase by 44{da793fdcd3fe679df000853cab620e3a76d4f41f7c86540cc967171bbb315377}, indicating a very optimistic foreseeable future in advance. This must guide to a lot more sturdy dollars flows, feeding into a greater share worth.

What This Means For You

Are you a shareholder? Since AAP is currently undervalued, it may perhaps be a good time to accumulate much more of your holdings in the stock. With a optimistic outlook on the horizon, it appears to be like this advancement has not nonetheless been completely factored into the share cost. On the other hand, there are also other variables this sort of as economic health and fitness to think about, which could explain the latest undervaluation.

Are you a probable trader? If you have been retaining an eye on AAP for a although, now may well be the time to make a leap. Its prosperous potential outlook isn’t absolutely reflected in the present share value nevertheless, which suggests it is not too late to get AAP. But in advance of you make any financial commitment choices, consider other factors these types of as the toughness of its equilibrium sheet, in get to make a well-informed expenditure final decision.

So although earnings good quality is important, it is really similarly vital to contemplate the pitfalls facing Progress Auto Areas at this issue in time. Situation in level: We have noticed 2 warning signs for Progress Vehicle Elements you should be aware of.

If you are no extended intrigued in Progress Automobile Sections, you can use our free system to see our list of more than 50 other shares with a substantial expansion possible.

Valuation is complicated, but we are assisting make it easy.

Discover out no matter whether Progress Vehicle Sections is possibly about or undervalued by checking out our detailed examination, which consists of good value estimates, pitfalls and warnings, dividends, insider transactions and financial health.

Perspective the Totally free Examination

Have suggestions on this report? Involved about the written content? Get in touch with us right. Alternatively, electronic mail editorial-crew (at) simplywallst.com.

This post by Simply Wall St is normal in character. We present commentary primarily based on historic info and analyst forecasts only using an impartial methodology and our content articles are not meant to be financial assistance. It does not constitute a suggestion to purchase or promote any stock, and does not take account of your targets, or your economical situation. We intention to bring you extended-time period centered evaluation driven by elementary data. Note that our evaluation may perhaps not element in the hottest value-sensitive firm bulletins or qualitative substance. Only Wall St has no situation in any stocks stated.